Introduction

Over the past months I’ve had the chance to work with finance sector. In workshops and one‑on‑one sessions we’ve explored how to use generative AI and agentic systems to automate routine tasks, surface insights and improve the customer experience. These sessions have been eye‑opening: when you pair a strong data culture with modern AI tools, even small teams can move faster and make better decisions. That observation isn’t just anecdotal. Recent research from Wharton and GBK Collective as well as several industry reports show that the financial services sector is among the leaders in turning AI investments into real, measurable returns.

Why focus on banking and finance? This industry is built on data and repetitive processes, from onboarding and know‑your‑customer (KYC) checks to loan underwriting, fraud monitoring and regulatory reporting. For decades these tasks have been done by humans slogging through forms, spreadsheets and rules. AI excels at exactly this kind of work: verifying documents, analysing patterns across millions of transactions and generating summaries or decisions in seconds. That’s why banks can see outsized benefits when they adopt AI thoughtfully. Below I’ve pulled together the most relevant findings from recent studies and my own client engagements, organised into three areas: sector‑specific examples, metrics for ROI and performance, and deeper implementation guidance.

Sector‑specific examples

1. Marketing and sales

Banks are using predictive models to forecast customer lifetime value and segment audiences, while generative tools craft personalised messaging. This combination drives higher engagement and conversion rates. JPMorgan reported that one global bank reported a 25% boost in engagement after tailoring mobile‑app content to individual spending habits. In practice this means training models on transaction history, demographics and product usage to identify customers who might be receptive to cross‑sell offers or retention campaigns. Rather than sending the same offer to everyone, AI allows marketers to deliver the right message at the right time.

2. Onboarding and KYC

Customer onboarding is often painful, requiring multiple documents and manual checks. AI can reduce friction by automating identity verification and pre‑populating forms. For example, computer‑vision models validate driver’s licences and passports in seconds, extract key data and compare it against trusted sources. Some investment banks have shaved 40% off their KYC verification costs by deploying AI across the workflow. Beyond document checks, chatbots guide new customers through the process, answer common questions and hand off to humans only when necessary.

3. Credit risk underwriting

Lenders are replacing rigid scoring rules with predictive models that analyse cash flow, account behaviour and alternative data (such as payment histories or mobile‑usage patterns). These models flag potential defaults earlier and allow banks to extend credit more fairly. Generative AI assists underwriters by drafting credit memos and narrative summaries, saving hours of writing. One community bank cut its commercial loan decision time from weeks to mere days by using an AI‑powered loan origination system that automatically scores applications and produces human‑readable rationale.

4. Risk and compliance

Fraud detection and regulatory compliance are natural fits for AI. Machine‑learning systems monitor transactions in real time to spot anomalies and evolving fraud patterns; generative models help write alert narratives and maintain audit trails. Banks have used AI‑driven check‑fraud detection to prevent hundreds of thousands of dollars in losses within months. In anti‑money‑laundering (AML) work, AI analyses massive volumes of transactions and customer profiles to identify suspicious behaviour, adapt to new schemes and reduce false positives. These tools free compliance teams to focus on higher‑value investigations and reduce regulatory risk.

Sample metrics for ROI and performance

Measuring the impact of AI is crucial. According to the latest Wharton/GBK survey, nearly three quarters of enterprises now track structured ROI metrics. In the banking context, here are some of the most useful measures:

- Employee engagement and productivity. Roughly half of organisations track usage metrics such as clicks, hours saved or number of transactions processed by AI. In banking this might involve measuring how many calls a chatbot handles, how many loan files an underwriting model processes or how much time agents save with AI‑generated summaries.

- Profitability and losses specific to AI initiatives. About 46% of companies monitor the financial outcomes of their AI projects. For example, cost savings from automated KYC, additional revenue from personalised offers or losses avoided thanks to real‑time fraud detection.

- Operational throughput and efficiency gains. Roughly 42% assess how AI accelerates workflows, such as the time taken to process loan applications or the number of compliance cases closed per week. Reductions in cycle time and manual handoffs are often the clearest signs of success.

- Time‑to‑productivity for new hires and skill development. More than a third of organisations measure how quickly employees become productive after AI tools are introduced. In a bank this could include the time new analysts need to learn to work alongside AI assistants or the speed with which branch staff adopt AI‑powered advisory tools.

By consistently tracking these metrics, banks can demonstrate the value of their AI investments, identify bottlenecks and build the case for scaling successful pilots.

Deeper implementation guidance

1. Start with focused pilots

Resist the temptation to “boil the ocean.” Choose high‑impact, low‑risk use cases (such as automating credit memos, automating onboarding checks or summarising regulatory reports) and run controlled pilots. Successful pilots should deliver measurable value within a few months and provide a blueprint for wider deployment.

2. Rewire workflows, not just bolt on tools

Leading banks aren’t simply layering AI on top of existing processes; they’re redesigning entire domains. For example, in credit underwriting they use multi‑agent systems where one agent extracts and checks collateral documents for fraud, another evaluates financials and a third generates a decision recommendation. This end‑to‑end rethinking delivers productivity gains of 20–60% and faster decisions.

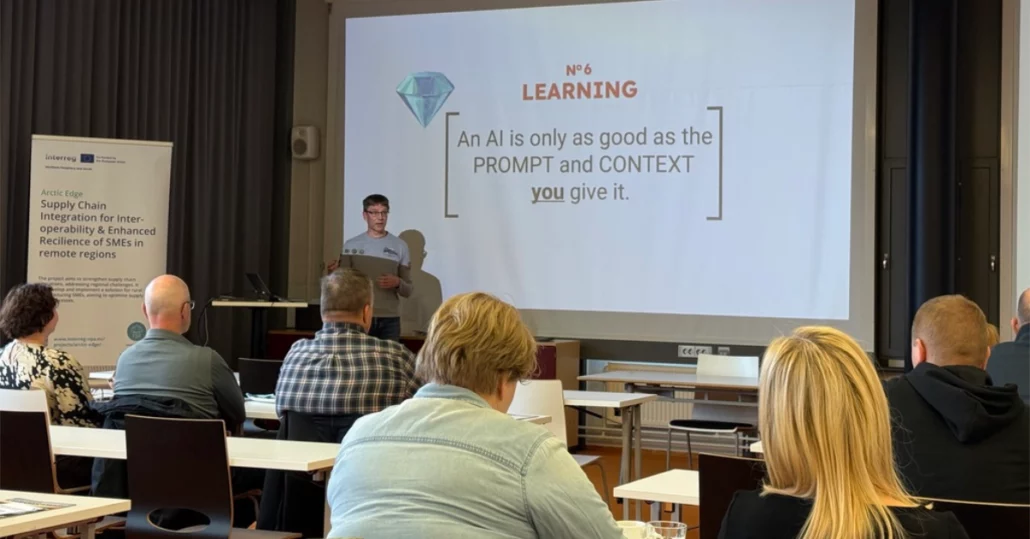

3. Keep humans in the loop and invest in training

AI augments human expertise, it doesn’t replace it. Experienced underwriters and compliance officers still need to review AI recommendations, provide context and make final decisions. Ongoing training is essential to prevent skill atrophy: teams must understand AI outputs, spot errors and learn how to ask the right questions. Leaders should schedule regular “AI learning” sessions and encourage staff to share what works and what doesn’t.

4. Establish strong governance and risk management

Finally, don’t neglect governance. Banks operate in heavily regulated environments, so AI applications require clear policies for data privacy, model explainability and bias mitigation. Risk‑proportionate oversight means that a low‑risk internal automation might be approved quickly, whereas an AI system making credit decisions must undergo rigorous review and be complient with EU AI act. Partner with vendors who understand financial regulations, and build a control tower to monitor model performance, compliance and value delivered.

Conclusion

AI is no longer a buzzword in banking. It’s (and can be) a practical toolkit that, when used thoughtfully, can enhance efficiency, reduce risk and deliver better experiences. By focusing on clear use cases, measuring what matters and embedding AI into workflows rather than treating it as an add‑on, banks of all sizes can unlock tangible value.

References

- McKinsey discussion of multi‑agent systems in credit underwriting

- Wharton/GBK survey metrics table detailing how organisations measure AI ROI

- Abrigo article on AI use cases across banking sectors

- nCino’s AI Trends in Banking 2025 report

- Ideas2IT article on generative AI use cases, including fraud detection and AML